Keep S&OP simple, but not too simple

Steven Depue - May 17, 2023

I’m a big believer in the KISS principle (keep it simple, stupid). But when it comes to sales and operations planning (S&OP), oversimplification can lead to disappointing results. I've seen this happen across many different industries, from complex B2B chemical and metals businesses to consumer goods companies operating in volatile markets. Despite the elegant theory of S&OP, it often fails to deliver in practice, leaving business leaders disappointed. So, what is the root cause of this issue?

The frustrations of disconnected S&OP

Blog post

One of the biggest issues I’ve seen with S&OP is a disconnect between the different levels of the organization. One leader told me that the local sales teams are still making their own sales plans, independent from — and sometimes in opposition to — the S&OP process conducted by the central SCM team. “And if you would look at the production plans of our factories, you would find no trace of some of the crucial S&OP strategies we’ve put in place.”

In many cases, input from the local teams is not used in a structured way, and company-level decisions are not communicated back systematically to the shop floors and sales teams.

Blog post

Why S&OP is no one-size-fits-all

My take on this? As I explain in this OMP e-book with real-world cases, S&OP is no one-size-fits-all. There’s no simple blueprint for companies to follow. That’s because the S&OP process must align with market dynamics and organizational realities, and these differ from one company to another. For example, highly demand-driven consumer goods companies generally have a more intricate demand validation process than highly supply-driven metals manufacturers.

Local teams of consumer goods companies know the dynamics of their markets and are good at making forecasts. However, their process also involves marketing teams that are confident in governing promotions and new product launches. In addition, insights from analytics and raw data, such as point-of-sales figures and correlation factors, guide their decision-making. All these inputs should be used to create the most accurate total demand signal possible for the operational teams to plan against.

This degree of interplay is much less prominent in a lot of B2B industries like the metals industry. But high involvement of local production and procurement experts is needed for reliable planning. There are also a lot of cross-plant flows to be planned and validated.

Craft the S&OP process to suit your situation

The reality for many companies is even more complex, since a combination of supply- and demand-related complexity is, in fact, the norm. And what works for one organization doesn’t necessarily work for another, even if they’re serving similar markets. It is tempting for an external consultant to advocate organizational change to simplify processes, but that doesn’t move the needle if you’re facing huge internal opposition.

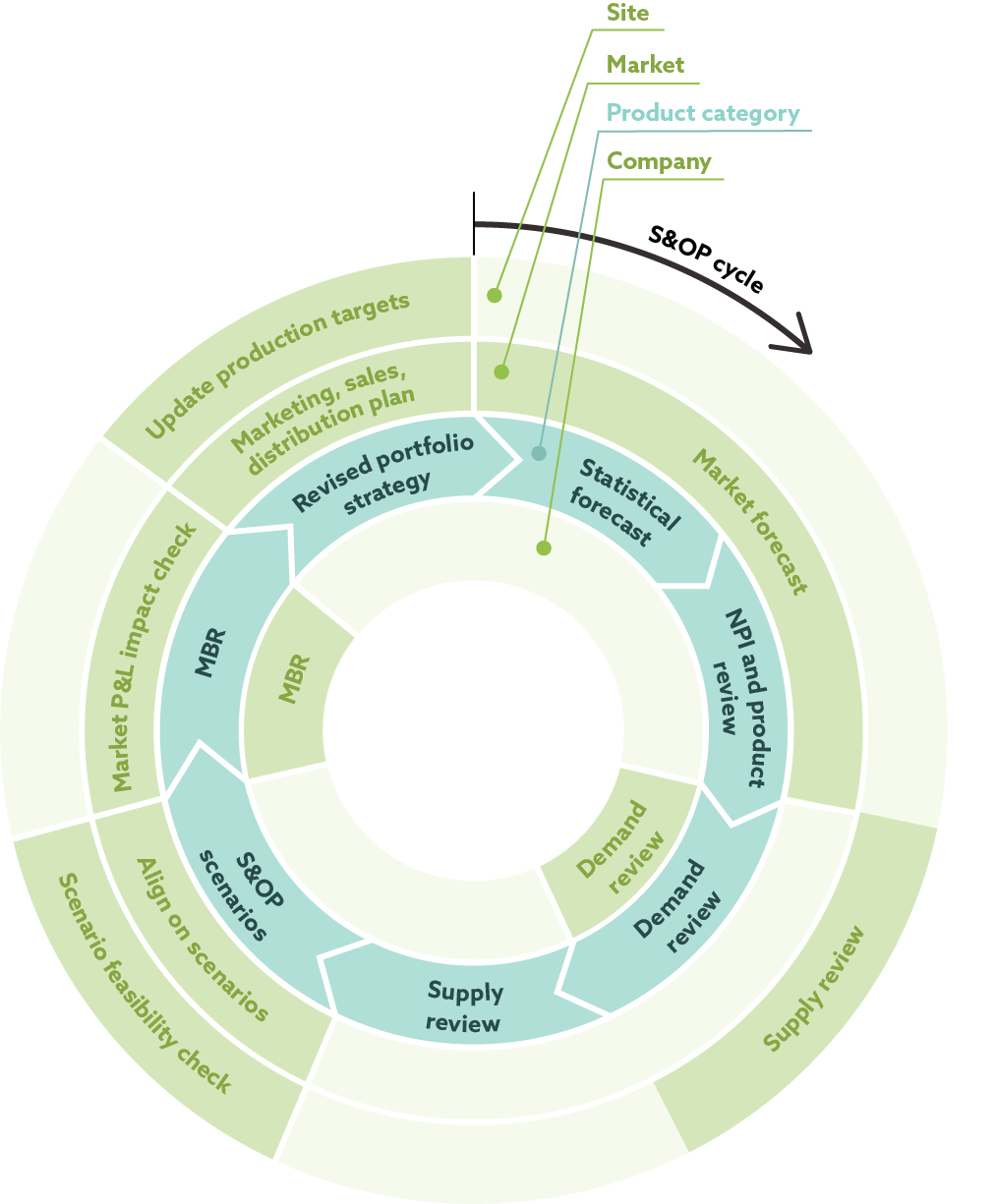

From theory:

To your company:

Illustration of multi-level S&OP process at a fast-moving consumer goods company

So, I advise companies to carefully craft their S&OP process to suit their specific needs. Introduce organizational change where it is appropriate and accepted. Put the decision-making power at the right level. And provide the right information flows and consultation rounds. Not too many, not too few. The resulting process may look more complex than in the elegant theory, but as Albert Einstein said: “Everything should be made as simple as possible, but not simpler.”

One powerful tool for achieving this balance is Unison Planning™, which can help you manage complexity while keeping your stakeholders aligned. If you're struggling with S&OP, I recommend downloading my e-book with real-world cases to help you tailor the process to your company's needs.

Steven Depue

Advisory Manager at OMP BE

Biography

With a background in management consulting and technology implementations, Steven delivers strategic and operational planning advice and customized solutions to meet the supply chain challenges faced by customers worldwide.