How decision-centric S&OP drives better results in the metals industry: bridging the gap between daily sales and monthly plans

Steven Depue - February 18, 2025

While many metals companies are gradually gaining in maturity by driving tactical planning through a monthly S&OP cycle, frustrations still arise when actual sales don’t follow the forecast (and they rarely do). Companies need to be able to take dynamic corrective action at any moment during the cycle. This kind of decision-centric S&OP leads to better service levels, less stock, and happier people on both the demand and supply sides.

S&OP plans get outdated quickly

The monthly S&OP cycle has proven its worth throughout different industries by aligning demand and supply, but it has inherent limitations, especially in turbulent times where demand is unstable and material availability and costs are changing rapidly. Companies have learned the hard way that reality sets in within days of the monthly plan being validated. Forecasted sales volumes can fail to materialize, while other opportunities can arise, and, for various reasons, supply issues can get in the way.

Because the metals industry is still somewhat decentralized, this can cause a degree of upheaval at the various production sites, with each trying to defend their own business. Sales people, in disbelief, are then inclined to turn their back on their S&OP plan, wondering how it could be of any use to them in their daily task of managing customer orders because it becomes so outdated so quickly. And then all this leads to infighting about reserving capacity on bottleneck machines.

Using the plan as a dynamic guide

We don’t want that, of course. That’s why, in Unison Planning™, we use the monthly plan not as a fixed thing but as a dynamic guide that allows companies to optimize their product mix, prioritizing the most profitable or strategically important product families and market segments.

A central sales administration team is in charge of the task. Known as ‘tactical order promising’, the approach puts in place a collaborative process between the sales teams and the supply organization, providing visibility on production volume allocations that must be adhered to. This avoids internal battles for production capacity, keeping supply feasible, thus maintaining service levels and preventing inventory piling up. It’s a decision-centric approach because intermediate action may be taken in the course of the month, in a controlled way, to adapt the plan to changing conditions.

Blog post

How tactical order promising works

Let’s illustrate this with an example. Consider an S&OP plan over a three-month horizon in which booked orders and forecasts are allocated to mills, taking into account constraints such as machine capacities, approved service levels, and inventory targets, leaving some supply unallocated for unforeseen circumstances. The figure below represents a simplified schema of this plan.

In the course of the month, many forecast volumes will be converted into booked orders, others could fail to convert or be postponed to the following month, and some previously unforeseen opportunities could arise. Swipe the carousel to the right to see how the forecast is converted into orders in the weeks between two S&OP meetings.

How can this be managed using the tactical order promising approach? Take the example of Mary, a sales representative in charge of a particular product family in a particular market segment. What can she do if she’s looking to book a new customer order a few days after the S&OP meeting? If she simply booked the order on the requested date or standard lead time, this might ignore the actual capacity situation as well as the validated S&OP decisions about the product families to be given preference.

Here are her options in a tactical order promising approach:

Blog post

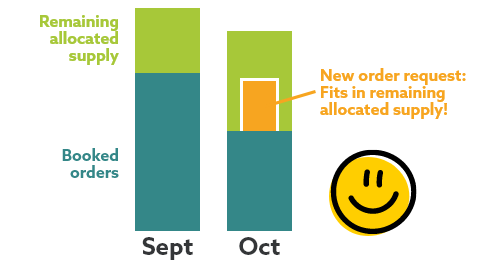

- Booking — If it’s an order related to her forecast, she routinely checks whether sufficient allocated supply is available (which should be okay) and books the order. The related forecast is adjusted automatically.

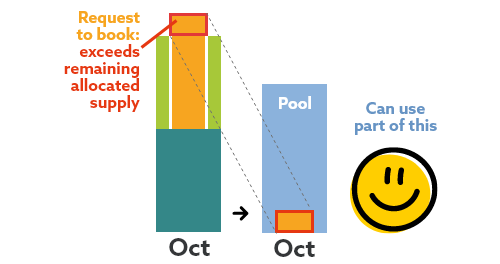

- Pooling — If it’s a new opportunity that was not in her forecast, she needs to contact the central sales administration team. If they find sufficient unallocated supply for comparable products, with similar impact on capacity and raw material requirements, they may decide to allocate it there. The data-driven S&OP model in Unison Planning allows them to check the impact on factors such as sourcing, manufacturing, transport costs, and lead times.

The admin team is automatically alerted by Unison Planning if there are segments with too many unconverted forecasts on the short horizon. The corresponding volumes are then transferred to the unallocated supply pool. Incidentally, Unison Planning prompts sales representatives to transfer volumes to the pool whenever they miss an expected sale.

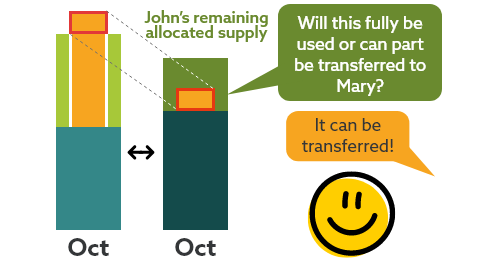

- Transferring—If there’s not enough unallocated supply left for Mary’s segment, the admin team carries out an ad hoc check with other sales representatives for no longer valid forecasts. If they find a suitable volume, for example, from John, a sales representative in charge of a different market segment, they may decide to transfer it to Mary’s opportunity. Again, the Unison Planning S&OP model allows them to check its impact immediately.

- Adjusting the plan — If the previous actions are not enough to produce the desired outcome, the admin team may want the whole supply plan to be escalated to the S&OE team. An example would be if supply volumes have become overbooked, perhaps by sales representatives less considerate than Mary. Escalation may lead to actions like organizing extra shifts or buying intermediates.

Blog post

Based on reality, producing real results

The approach discussed above is based on real situations and produces real results. It is referred to as tactical order promising because it’s a smarter and more collaborative way to manage orders and make promises to customers. It endorses cooperation between sales and supply, with a central sales administration team acting as gatekeeper to ensure the S&OP decisions related to sales are adhered to as much as possible and escalating issues to supply if needed.

The data-driven S&OP model in Unison Planning supports decision-making. This means overbookings are avoided, supply is kept feasible, service levels are maintained, and stocks remain within the defined ranges.

Want to discover more real-life cases, a strategy, and a multi-level approach to deploying organization-proof S&OP?

Steven Depue

Advisory Manager at OMP BE

Biography

With a background in management consulting and technology implementations, Steven delivers strategic and operational planning advice and customized solutions to meet the supply chain challenges faced by customers worldwide.